What does staking crypto mean

What Are Staking Pools?

Non-custodial: The service provider offers a platform or software client that enables the user to stake their cryptocurrency themselves without having to transfer it to the service provider. Although this approach gives the user greater control over their investment, it requires the user to have more technical expertise. Crypto staking explained PancakeSwap is a decentralized DeFi application on the Binance Smart Chain. It offers a secure and fast automated liquidity protocol, enabling users to easily swap or stake their cryptocurrencies. With PancakeSwap, users can become liquidity providers, farm yield-generating tokens, stake funds for rewards, and more. It also has a cryptocurrency exchange feature that allows users to access fast and low-cost automated buying and selling of digital assets at competitive rates.Stake crypto meaning

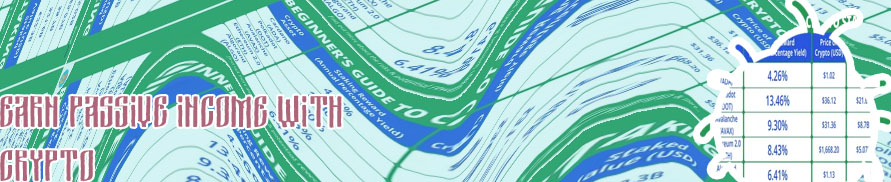

You can check out several cryptocurrencies to stake at Crypto.Com, including some stablecoins. Is Crypto Staking the New Savings Account? Crypto staking is one way of earning passive income, which does not require daily effort after an initial investment. And while staking may be a good choice for some cryptocurrency owners, there are many other ways of generating passive income. It may be worth looking into some of those options, as well.Understanding Proof-of-Stake (PoS)

Both groups overlook or under-appreciate the value of Bitcoin’s ultimate security. No cryptocurrency, fiat currency, or even commodity-based money can match the security and immutability of Bitcoin’s blockchain. For high-value transactions, security and reliability are often more important than speed. Thus, Bitcoin’s energy consumption is well worth the cost, as indicated by the strong demand to transact on the Bitcoin blockchain. No cryptocurrency which has attempted to replicate Bitcoin and eliminate its energy requirements has established sufficient security and decentralization, precisely because Proof-of-Work converts energy into security. The Proof-of-Stake Model So, now that I’ve deposited my ETH into the ETH2 Proof-Of-Stake option of choice, does this what benefits become available upon launch of the Ethereum 2.0 network? What I mean is, as a traditional stakeholder in a companies stock would reap the benefit of buying into the stock further but at the reduced priced of that stock when the stockholder first purchased it- Would there be any similar benefit to staking ETH2, any more incentive than just the 6% that is offered now?How does crypto staking work

Cryptocurrencies pay people to secure their networks. The most famous example is Bitcoin (BTC), which uses a Proof of Work (POW) mining algorithm. However, mining has downsides like high energy consumption and technical difficulty (buying and setting up ASICs requires some technical knowledge). Both of these factors can dissuade would-be miners from mining crypto. Proof of Stake Blockchains Activation period: On some blockchains, staked coins do not start earning rewards as soon as they are staked. Often, users may have to wait until the beginning of a new epoch for their stake to start earning staking rewards. The activation period then refers to the period between the staking commitment of the user and the integration of the stake into the active Proof-of-Stake consensus mechanism.

Home

Bitcoin cryptocurrencyBtc value usdSafe dollar cryptoWifedoge crypto priceHow to buy safemoon on cryptocomNew crypto coinsCrypto miningWho own bitcoinCryptocurrency exchangesCryptocom trading feesCrypto com not workingWhere to buy cryptoBtc creatorHow to invest in cryptocomCryptocurrency bitcoin price1 btc in usdCrypto feesCryptocom card limitsBitcoin price fallingCryptocurrency pricesWhat is btc miningСинонимWhere to buy new crypto coinsHow to sell on cryptocomGoogle bitcoinBinance bitcoinCryptosSend bitcoinCryptocurrency appHex crypto priceCryptocom loginHow to transfer from coinbase to cryptocomWhat the hell is bitcoinGas fees ethWhat is crypto coinBrand new cryptoWhere to buy theta cryptoCan you buy dogecoin on cryptocomCryptocom coins availableHow to trade btcBest crypto sitesWhere to buy bitcoinHow much is dogecoinCurrent eth gas priceEthereum cryptoHow to withdraw money from cryptocomBest crypto to buyMana crypto priceShiba inu coin cryptocurrencyLitecoin cryptoCrypto white paperCheapest crypto on crypto comLink crypto priceTo invest all profits in cryptoStaking cryptoHow much to buy dogecoinHow to buy on cryptocomEthereum chart priceCrypto to buy nowAll crypto coinsTop cryptosHow to buy dogecoin stock on coinbaseCryptocom transfer to walletBuy bitcoin with credit card instantlyCryptocoin com coin